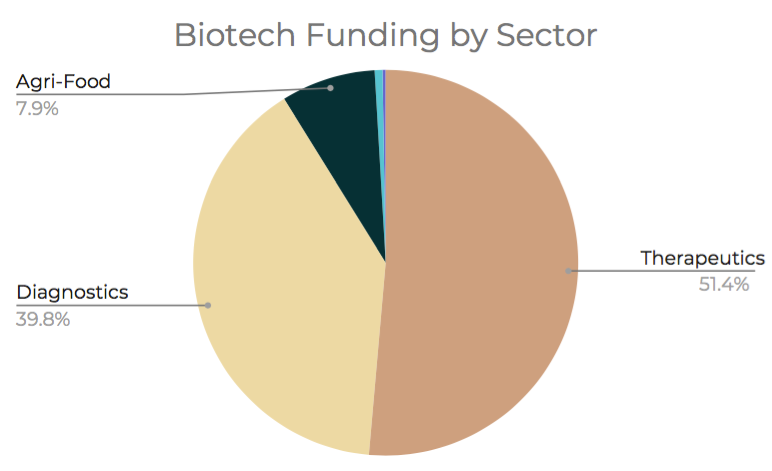

Biotechnology has emerged as one of the key technology enablers of the 21st century, disrupting traditional agri-food systems, diagnostics and therapeutics industries as well. As per the recently published India Deep Science Tech Report by Ankur Capital, more than $900 million were invested into breakthrough deep science biotechnology startups between 2013 and 2023 in India. Driven by a need to develop solutions against COVID-19 and Antimicrobial Resistance (AMR), the period between 2020 and 2023 saw growth stage investments into multiple diagnostics as well as therapeutics startups to scale their solutions.

Source: India Deep Science Tech Report

The past two decades have seen three key breakthroughs which have paved the way for biotechnology-led solutions to become a reality.

Next Generation Sequencing: Faster sequencing of genomic information (whole genome, exome, and genes) has led to an explosion of genomic data and novel biomarkers. The cost of sequencing has fallen even faster than the exponential increase of computing power dictated by Moore’s law.

CRISPR gene editing: The 2012 discovery of the CRISPR-Cas9 genome-editing toolkit opened doors for highly targeted genetic modifications to address challenges in therapeutics, diagnostics as well as other industries.

AI-based multi-omic modelling: New machine learning and deep learning models such as AlphaFold for protein sequences, and structures is accelerating the discovery of novel Biomolecules.

The therapeutics industry has seen a shift in the last few years towards biotechnology-based products. Monoclonal antibodies such as Humira and Keytruda are some of the largest selling drugs in the world with sales of $14 billion and $24 billion each in 2023. Four of the top six biopharmaceutical products sold worldwide were large molecules such as antibodies, mRNA vaccines and peptides. The availability of genomic data and relevant biological DNA/RNA/protein disease markers have made personalised medicine such as cell and gene therapy a reality. India, which has traditionally been a large market for biosimilars and bio better drugs, has also seen an uptick in novel drug development over the last decade. Companies such as Bugworks, Zumutor Biologics, Eyestem Research, ImmunoACT are developing novel biological products and have taken significant strides towards commercialising their products. Eyestem is developing a scalable cell therapy solution for treating Dry-AMD (Age-related Macular Degeneration). Zumutor has received IND approval for its first-in-class anti-LLT1 monoclonal antibody against prostate cancer, B-cell lymphoma and Glioma.

Source: India Deep Science Tech Report

Molecular diagnostics came of age in 2020 and was the technology of choice to diagnose COVID-19 at an early stage. Novel DNA amplification and editing enzymatic systems such as Cas-9 are now being used to develop highly sensitive and specific molecular diagnostics solutions for early diagnosis of infectious diseases, cancers and other life-threatening diseases. MolBio Diagnostics, which has developed a Truelab Real-Time quantitative micro PCR system became the first molecular diagnostics company in India to be valued at over $1 billion. Startups such as DNome, CRISPR Bits, and Adiuvo Diagnostics are developing disruptive molecular diagnostics solutions, using protein engineering, synthetic biology and advanced gene editing technologies.

India is emerging as a manufacturing hub for specialty chemicals, an industry valued at $32 billion. The industry is looking for sustainable process alternatives to meet its net zero targets, and biological processes using either fermentation or enzymes are a viable solution. Startups such as Quantumzyme, KCat Enzymes, and Fermentech Labs are developing novel enzymes to replace the existing chemical-based processes while also improving the conversion efficiencies and reducing the carbon footprint of the processes.

The opportunities are massive, but challenges exist. Grants like Biotechnology Industry Research Assistance Council (BIRAC) - Biotechnology Ignition Grant (BIG), and Startup India help in the early stage of product development and prototyping, however, private venture capital is still relatively nascent in the country. While seed-stage capital for early technological derisking has been readily available of late, later capital at the Series A stage and beyond has been limited to a few key sectors and investors. Secondly, there is limited participation from domestic corporates and strategic investors. Regulations also need to keep pace with technological advancements. Finally, startups particularly at the early-stage face challenges in attracting key personnel who can drive engineering, strategy and sales. There is a need for techno-commercial talent from the industry to take the plunge and join these startups to accelerate commercialisation.

Engineering Derisking & Tech

Biotechnology companies need to have technology-derisking strategies before commercialising the products.

Source: India Deep Science Tech Report

As a biotech company scales, its innovation is approaching market-readiness. At this point, the company’s priority is to secure early revenue; to do so, the company needs to show efficacy and economic viability at the scale of real-world deployment as well as in manufacturing. This usually involves engineering de-risking. In some cases, the product will also need to go through regulatory or qualification processes, extensive clinical trials, third-party pilot validation and IP protection for the core technology before market readiness. Companies such as String Bio, after developing the products at the lab scale or at 50 litre fermenter capacity, have carried out extensive pilots for their products in the fields as well as in collaboration with reputed universities to generate pilot field data on the performance of the products. The company also has 15 granted patents with another 38 filed, showcasing a robust patenting strategy for their technology.

Scaling up in biotech is another challenge. Processes need to be optimised at different scales, purification needs to be standardised and product characteristics have to be studied before commercialisation. Several first-generation startups in India in the biotechnology sector are at the stage of scaling up their technology and the next few years will define their success as well as the success of the industry as a whole.

Suraj Nair, Lead, TechSprouts, Ankur Capital