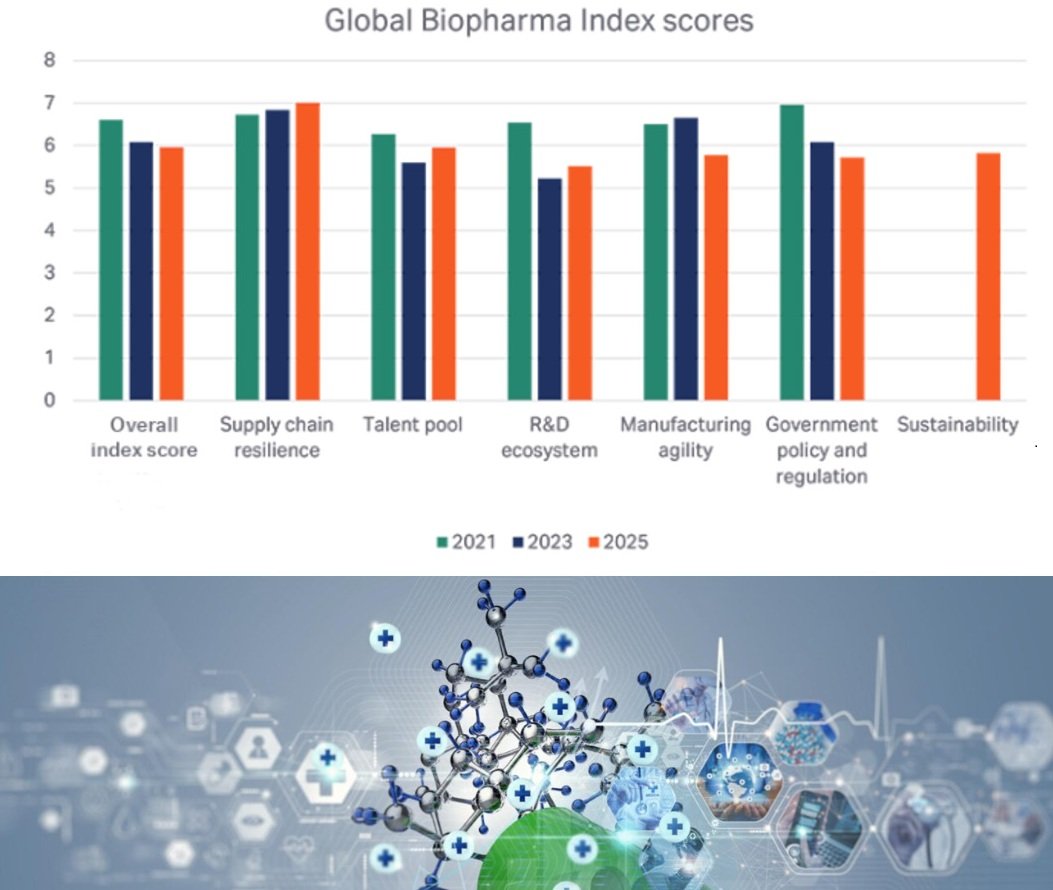

The bioscience industry is undergoing significant transformation, shaped by global trends and regional dynamics while simultaneously adapting to emerging challenges and opportunities. The ever-evolving sector faces challenges driven by shifting priorities in supply chain resilience, talent development, regulatory complexities and so forth. Collaboration among industry leaders, governments, and research institutions is crucial to overcoming these hurdles and meeting the growing demand for advanced therapies. A recent Global Biopharma Index by Biopharma giant Cytiva highlights how strategic investments and regional focus are reenforcing the industry's landscape.

Compared with 2023, economic strength is less predictive of biopharma resilience. The 2025 data show that some upper-middle-income countries are gaining ground, particularly if they focus on investments in advanced manufacturing, regulatory reform, and innovation incentives.

Michael May, President and CEO, Centre for the Commercialization of Regenerative Medicine (CCRM), says: “The world is shifting from globalization to more regional perspectives, partly due to politics, economics, and the diminished focus on COVID. But to bring sophisticated products to market, we need to be as collaborative as we’ve ever been.”

An in-depth look at the six pillars of resilience

• Supply chain resilience is improving with 55% of executives stating they believe their country’s biopharma supply chains are more robust than 12 months ago. However, more than a quarter surveyed said their supply chain was not equipped to support advanced modalities such as cell and gene therapies. 76% predict that geopolitical volatility will significantly impact their sourcing strategies, while 56% agree that domestic manufacturing of biologics is set to increase dramatically over the next three years.

• The talent pool has improved slightly but continues to be a challenge for the biopharma industry. Approximately one third of executives reported severe or critical shortages in key areas associated with advanced drug modalities, such as cell and gene therapies, mRNA, and antibody drug conjugates (ADCs), sustainability, manufacturing, digital, and AI skills.

• The R&D Ecosystem pillar is stronger than it was 2023. Countries that score highly on this pillar are more likely to bring therapies to market faster. Collaboration is key to a strong R&D ecosystem and nearly half of respondents said it remains difficult to find high quality partners, such as CROs/CDMOs, academic research institutions, and government labs and think tanks.

• Manufacturing agility is central to biopharma’s ability to respond to changing demand. 2025 data shows that many firms lack the ability to scale production quickly. One in four executives surveyed said their organization would be slow or very slow to ramp up manufacturing of hormone-based products, mRNA vaccines, and cell and gene therapies.

• Government policies and regulation are critical to the biopharma industry. However, our data shows that many executives struggle with fragmented, unpredictable policy environments. 51% say government policy is inconsistent and 50% say it is now harder to raise capital due to current market conditions.

• Sustainability is a strategic priority across many industries but almost half of biopharma executives report that their company fails to achieve its sustainability targets. Nearly two-thirds say their company deprioritizes sustainability due to short-term financial pressures and competing business priorities. 34% report talent shortages in sustainability roles.

Pierre-Alain Ruffieux says: "Continuous evolution and collaboration, particularly between government agencies and industry partners, is essential to ensuring the biopharma industry can meet global demands.”