BioSpectrum Exclusive: Can Cipla be the next target on Teva's to-do list?

28 April 2015 | Analysis | By BioSpectrum Bureau

BioSpectrum Exclusive: Can Cipla be the next target on Teva's to-do list?

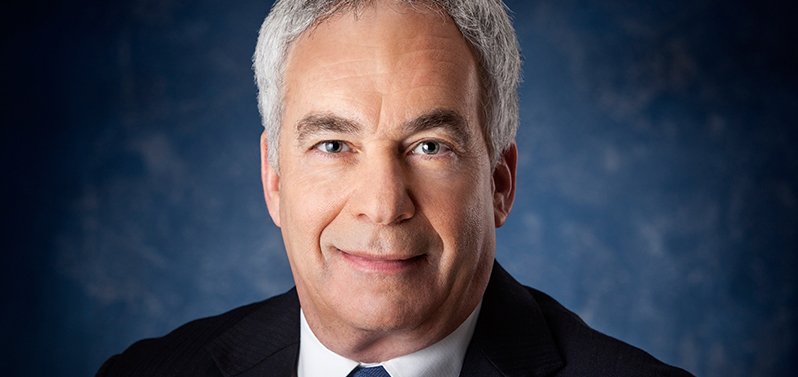

Mr Erez Vigodman, president & CEO, Teva Pharmaceutical Industries

Singapore: In Jerusalem, it is 8:45AM on the morning of Tuesday, April 21, 2015, when Israeli pharma behemoth, Teva Pharmaceuticals, officially announced on its website, its proposal to acquire its long-time arch rival Mylan, a thriving global generics manufacturer.

The big deal

The new deal on the block has shaken the pharmaceutical industry worldwide since it would create a global generics powerhouse, with the combined Teva-Mylan entity having approximately $30 billion in pro forma 2014 annual sales, and boasting a pipeline of more than 400 pending generic drug applications at the US Food and Drug Administration (USFDA).

"The combined entity would be well positioned to transform the global generics space and would be able to leverage its significantly more efficient and advanced infrastructure, with an enhanced scale, production network, end-to-end product portfolio, commercialization capabilities, and geographic reach," said Mr Gianfranco Zeppetelli, deals analyst, GlobalData, a global research and consulting firm.

The bid has also initiated worries of a possible increase in the generic drug prices. Mylan is said to be the current US leader in the world's largest generics prescription market, recording a total revenues of $7.7 billion in the fiscal year (FY) 2014.

The largest contributor to this is the popular EpiPen auto injector (epinephrine [INN]), an emergency treatment for anaphylaxis, which accounts for 18 percent of the company's generic sales.

Through this deal, Teva would gain a significant stronghold in the US generics market and would further extend its global reach.

If successful, the merged entity would benefit from the most advanced R&D capabilities in the generics industry, and can become the world's leading integrated API division, allowing it to focus on biosimilars, vaccines and respiratory products.

Mr Zeppetelli pointed, "Many current respiratory active ingredients have a looming patent expiry and would allow generic companies to create new formulations with their own inhalers. Blockbuster anti-depressant Cymbalta is also on the verge of expiry and could be exploited as a potential generic drug."

Teva in a statement said that the proposed merger would benefit from leading positions in multiple sclerosis, respiratory, pain, migraine, movement disorders and allergy therapeutics.Teva expects the proposed transaction to be complete by the end of 2015.

Teva vs Perrigo vs Mylan

During the beginning of April, Mylan voiced out its plan to buy Irish-based Perrigo for $29 billion, a manufacturer of private label over-the-counter (OTC) products.

Teva was against Mylan's plan of buying the Irish company, since that would create a much bigger entity before it could swallow Mylan.

"....This (Teva-Mylan) proposal is contingent on Mylan not completing its proposed acquisition of Perrigo or any other alternative transactions," Teva said.Perrigo ultimately rebuked Mylan's offer stating that the offer was too low for it to consider, making the situation more favorable for Teva's deal proposal.

Impact on Indian collaborations

Mylan's Indian subsidiary, in February 2015, entered into an agreement with Gilead Sciences to exclusively distribute its hepatitis C drug Sovaldi and Harvoni in India.

The same month, Mylan entered into another deal with India-based Famy Care, acquiring its female health care businesses for $750 million.

Two days after the Teva's deal became officially public, On April 23, 2015, Mylan's subsidiary launched generic Sofosbuvir 400 mg tablets under the brand name MyHep in India, used for treating hepatitis C.

Since 2009, Biocon and Mylan have been partnering together in making portfolios of biosimilars and complex biologics.

The dynamic duo have also been engaged in developing generic insulin drugs.

In February 2013, both entered into another partnership, to develop Biocon's generic versions of three insulin analog products - Glargine (generic version of Sanofi's Lantus), Lispro (generic version of Eli Lilly's Humalog) and Aspart (generic version of Novo Nordisk's NovoLog), with Mylan having exclusive commercialization rights in the US, Canada, Australia, New Zealand, and the European Union (EU).

In February 2014, Mylan in partnership with Biocon launched world's first trastuzumab biosimilar in India, Hertraz, which is the biosimilar version of Roche's Herceptin.

On the other hand, Natco Pharma, signed a deal with Mylan in 2008 to license its glatiramer acetate pre-filled syringes, which is a generic version of Teva's Copaxone, used in treating multiple sclerosis (MS).

Indian generic makers tight lipped

Analyst Mr Zeppetelli believes that Indian companies, such as Biocon and Natco Pharma, could be under threat from Teva should the deal go through.

When approached Biocon for a quick comment, the company failed to respond.

Sun Pharma's spokesperson replied in an email saying, "We have no comments to offer."

Natco Pharma's HQ in Hyderabad neither received calls nor responded to the email sent by BioSpectrum seeking a statement on the impact on its business as a result of the proposed deal.

It is believed that Natco may seek out other partners if the proposed merger happens.

"Teva's established standing in Europe, and Mylan's established standing in the US can only be favored by such a deal and it could drive Indian company products away, especially when these products have been having issues with the regulatory watchdogs in the European Medicines Agency (EMEA)," Mr Zeppetelli opined.

Generic giant Dr Reddy's spokeswoman too declined to comment on the developments.

The generic drug industry has been consolidating as a way of dealing with fewer blockbuster brand-name drugs to copy, rising competition from upstarts in India, and a pricing squeeze in Europe and other developed markets.

Actavis will certainly have been alerted by the deal, as the proposed Teva-Mylan company would create an even bigger rival while also increasing competition in the generics market.

Earlier Lupin told Live Mint, "......The deal would not only create the world's largest generic-drug manufacturer but would also very visibly alter the competitive landscape and market dynamics in key markets like the US and Europe."

Why Mylan?

Teva's top-selling multiple sclerosis drug, Copaxone, lost exclusivity earlier this year. Thanks to a court decision invalidating Teva's September 2015 patent.

Mylan said that it was poised to launch its own versions, but Teva appealed to the Supreme Court, which agreed to hear its case.

Teva also reminded the generics makers that if they launched, and the high court ruled against them, it could collect twice the company's sales in damages.

So far, no generic has yet been launched. However, the reprieve will definitely end when the patent expires in September - if not sooner.

Analysts believe that Mylan believes in a stand-alone strategy, which is one of the main reasons why the company has opposed Teva's move.

"Its proposed acquisition of Perrigo represented a defensive play against a possible hostile takeover. The potential Teva-Mylan combination has been seen to be without sound industrial logic or cultural fit. There would be a significant overlap in the companies' businesses and there could be issues of anti-trust regulatory clearances," commented Mr Zeppetelli.

On April 21, 2015, Mr Erez Vigodman, Teva's president and CEO addressed a letter to Mr Robert J Coury, executive chairman, Mylan, explaining how this deal would benefit Mylan's stakeholders.

"This transaction is unique in what it accomplishes for Mylan stockholders: a meaningful upfront premium, significant and immediate cash consideration and liquidity, as well as ownership in a leading global pharmaceuticals company from which they can benefit from the upside created by our combination. These benefits are not available to Mylan stockholders in the proposed acquisition of Perrigo or its stand-alone strategy," it read.

Teva's Indian target?

If Teva's eyes were to fall on an Indian pharma company, analysts believe that a potential candidate would be Mumbai-based drugmaker Cipla, which could be a way of expanding Teva's reach to South America, as shown by Cipla's recent acquisition of Duomed Produtos Farmaceuticos, a two-year-old importer and distributor of pharma products in Brazil.