GlobalData reveals role of Japan’s immunology market in branded digital marketing space

15 December 2020 | Analysis

The market landscape is expected to face huge biosimilar competition in the future

Photo Credit: GlobalData

The Japanese immunology market is highly competitive with many innovator products available for rheumatoid arthritis (RA), psoriasis (PsO), psoriatic arthritis (PsA), inflammatory bowel disease (IBD) comprising ulcerative colitis (UC) and Crohn’s disease (CD), and ankylosing spondylitis (AS) indications. Across these indications, the branded support available for initially approved therapies dominate the digital marketing space compared to the support available for newly approved products, finds GlobalData, a leading data and analytics company.

According to GlobalData’s Pharmaceutical Intelligence Center, there are a total of 21 innovator products approved in the Japanese market for immunology indications, including the leading brands, such as Remicade, Enbrel, Humira, Simponi, and Stelara, as well as those approved in the last five years such as Lumicef, Taltz, Kevzara, Tremfya, Entyvio, Skyrizi, Smyraf, Rinvoq, and Ilumya.

Venkat Kartheek Vale, Pharma Analyst at GlobalData, comments: “The growth in the immunology market is driven by increasing prevalence and awareness of immunological diseases as well as by innovation in the pipeline. However, the landscape is expected to face huge biosimilar competition in the future and the current market leaders are focusing on continuous patient engagement through branded digital channels to remain dominant in the market over a long period.”

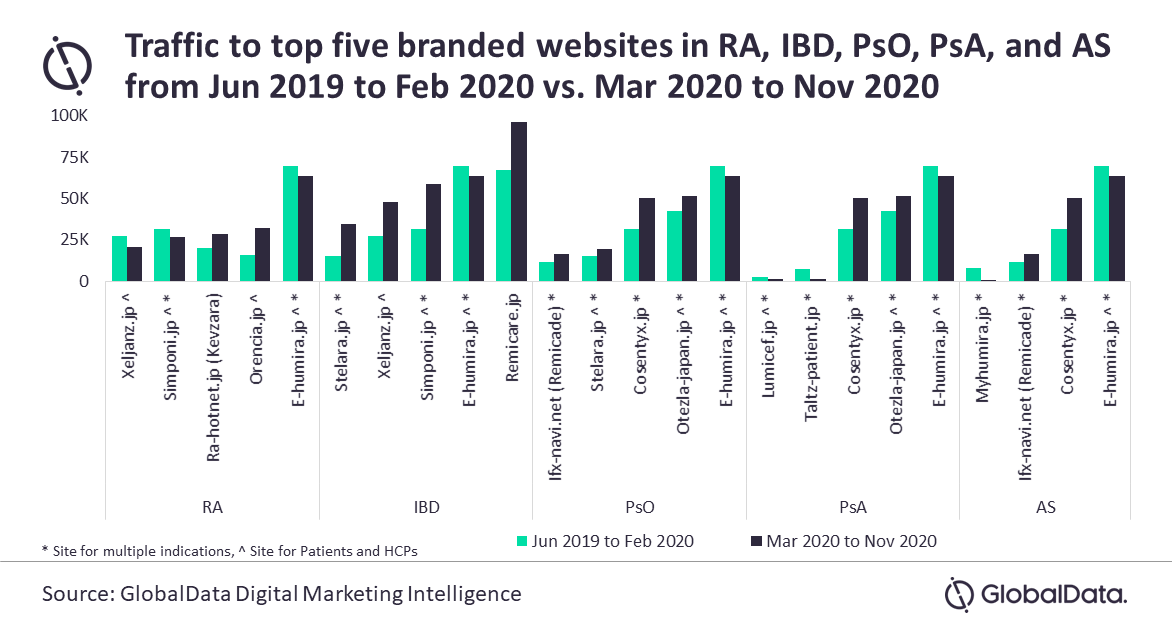

An analysis of traffic to the top five branded websites in RA, IBD, PsO, PsA, and AS indications over the 18 months (June 2019–February 2020 vs. March 2020–November 2020) revealed the highest traffic to AbbVie’s E-humira.jp in RA, PsO, PsA, and AS indications while Janssen’s Remicare.jp is the leading one in IBD.

Among the therapies approved in the last five years, only Sanofi’s Kevzara (Sep 2017) for RA, and Kyowa Kirin’s Lumicef (Jul 2016) and Lilly’s Taltz (Jul 2016) for PsA secured positions in the top five websites. Therapies such as Astellas’ Smyraf (Mar 2019) and AbbVie’s Rinvoq (Jan 2020) for RA, Takeda’s Entyvio (Jul 2018) for IBD, Janssen’s Tremfya (Mar 2018) and AbbVie’s Skyrizi (Mar 2019) for PsO and PsA, and Lilly’s Taltz (Nov 2019) for AS are lagging with significantly less traffic. The recently approved product Ilumya (Jun 2020) for PsO does not have a branded website yet to support the patients.

Vale concludes: “Although there is intense competition in immunology markets across the globe, innovator companies are working hard to sustain their presence and promote the treatment benefits of their products through branded channels. This can serve as a great example for novel entrants in the market to scale-up their digital portfolio and strengthen their online presence to initiate conversation with new patients and improve the relationship with existing ones.”